For small businesses, finding the finest free invoicing software isn’t that tough. There are so many options, and some of them aren’t even worth your time. It’s exactly like any other business, and yours needs to be functioning as swiftly and efficiently as possible to be successful.

Maintaining a good cash flow may make or break your firm, especially if you’re just getting started. Invoicing and billing software can help everything run smoothly if you use a good one.

[lwptoc]

Best Invoicing Software Free For Small Businesses

Are you looking for the best small company invoicing software? To help you out, I have compiled a list of the top free invoicing apps we’ve found.

ZipBooks

The best simple invoice software and accounting software for small businesses is ZipBooks. ZipBooks is a relatively new company compared to the others, but its simplicity, cost (free!), and ease of billing are praised by customers. The company has a lot of power based on customer reviews, yet it’s a newer and smaller organization. There’s an iOS app, but no Android app yet.

Intuit Quickbooks

Self-employed folks can use Intuit Quickbooks to keep track of their finances and invoice small businesses. TurboTax is a well-known product in the United States because the same business developed it.

A self-employed profession that requires a lot of driving can benefit greatly from Intuit Quickbooks’ basic accounting tools, including invoicing, accounts receivable, and accounts payable, as well as an app that can automatically keep track of your kilometers driven.

Intuit Quickbooks’ tracking tool is a compelling enough cause in and of itself. However, Intuit Quickbooks also features a wide range of integrations, making it a streamlined experience for your business. For example, Intuit Quickbooks is a lifesaver when completing our taxes and working with independent contractors.

Many independent contractors and freelancers use Intuit Quickbooks Self-Employed to track and compute their quarterly taxes. As a result, it’s now easier than ever to understand how your personal and business expenses are split up.

Scalability is a drawback of the Self-Employed plan; it can be challenging to add more employees or businesses to your plan. In addition, there is no way to scale or upgrade to another plan with this plan.

If you add a new employee, you’ll have to start over with another one of Intuit’s Quickbooks plans from begin. Nevertheless, it’s a worthy addition to our best small business invoicing software list.

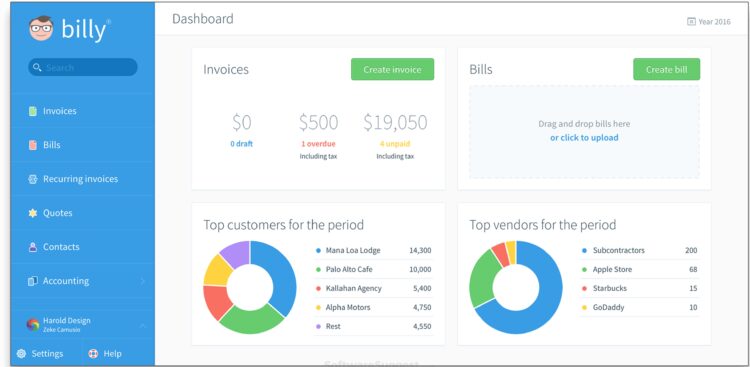

Billy Free Invoicing Software

Billy is one of the most affordable options available in terms of cost. It costs $15 per month for the cheapest plan and $19 per month for the most popular Gold plan. In addition, the free trial version of Billy doesn’t require your credit card details to begin, so you can start using it right away if you aren’t sure yet.

Users may make invoices quickly and easily with Billy’s user-friendly interface. As a result, Billy is perfect for those who despise overly complex software requiring a high level of technical proficiency and a lot of practice. In addition, Billy has drawn in a wide range of non-accountants and non-specialized accounting users because of its straightforward design and lack of distracting extra features.

Don’t be deceived, though, by Billy’s seeming simplicity; it still packs a tremendous punch, offering features like accounts payable and receivable as well as an eye-opening financial dashboard.

Billy isn’t without flaws, however. If you’re expecting a lot of integrations like other online bill pay services, Billy isn’t for you. For example, there is no PayPal payment option.

There are still several issues with the mobile app, such as the absence of pop-up timers for tracking the progress of projects and invoicing hours. However, you may rest assured that Billy is still being upgraded, and things will only get better.

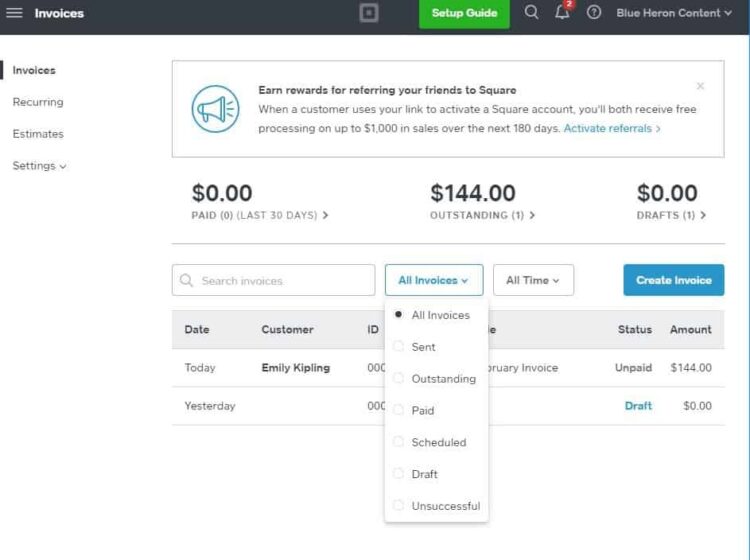

Square Invoices

If you don’t send invoices very often, Square Invoices is the perfect option for you. No monthly subscription charge means that sending occasional bills is inexpensive and straightforward. It’s a godsend for small firms to have software like this. It’s ideal for low-to-medium workloads, and it’s completely free.

You will only have to pay 2.9 percent + $0.30 for each transaction if your consumers pay online with a credit card. In this case, the price can rise to 3.5% + $0.15 if you keep the customer’s credit card details on file and charge them immediately.

If you’re looking for an all-encompassing online invoicing solution, you may want to look elsewhere. For example, it has customizable invoices, payment reminders for overdue bills, and credit card payments as some of its most basic features. However, if you’re ready to commit to using Square Invoices for your business, you’ll be able to access more sophisticated features in your online Square account.

Square Invoices also boasts one of the best mobile credit card readers on the market. So when it comes to invoicing software for small businesses, there’s no better option than Square Invoice.

Weareindy

Indy’s Indy Invoices Tool is a fantastic option for freelancers.

It’s quick and straightforward to use. Proposals, contracts, and bills can all be created and sent to clients using templates. In addition, because all administrative functions are integrated into a single platform, the process is much more efficient.

When you use Indy’s simple Time Tracker, you can quickly add unbilled hours from your project list, as well as unbilled hours from your contacts list, to create an invoice. In addition, stripe, PayPal, Zelle, and other services let customers pay with a credit card or bank transfer.

- Free Option? Yes, a free trial is available.

- Price: $5.99 per month

- No extra fees or setup costs

- Quick billing

- Accept multiple forms of payment.

- Customizable templates

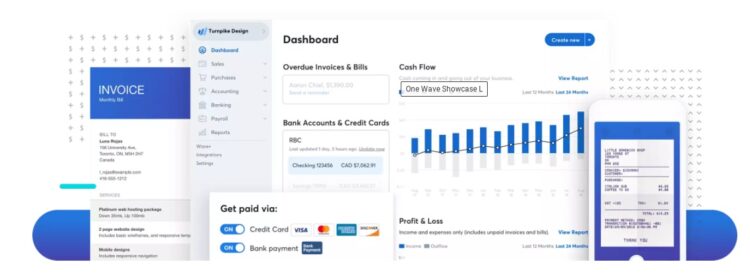

Wave

To get you started, Wave is a completely free invoice app. When it comes to invoicing and estimates, there is no limit to how many you may create; you can also manage your contacts; track expenses, and generate reports for free.

Wave’s payroll software is required if you wish to use the service to transfer money. As a result of this price, your invoicing and payroll software will be integrated seamlessly.

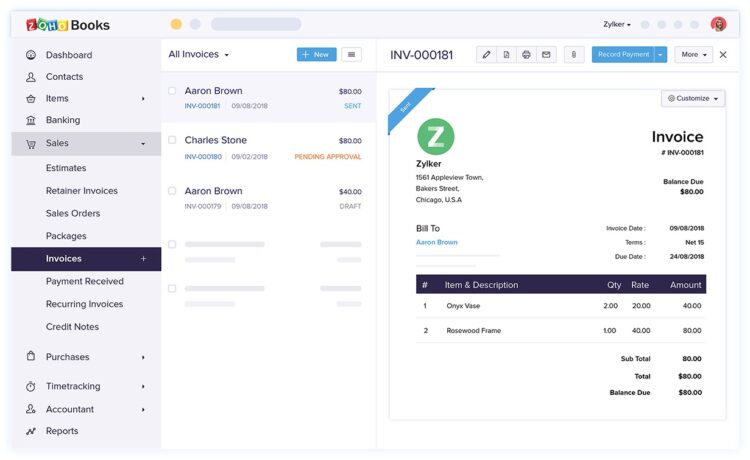

Zoho Invoice

Looking for a small company invoice management system? Without charging, small businesses with five customers can use Zoho’s free invoicing software. One of the more cost-effective options when you build up. Using Zoho costs just $7 per month for up to 50 clients and $15 per month for 500 clients. Additionally, being one of the few free invoice apps for small businesses, it’s also one of the best.

Allows for the creation of invoices, as well as quotes and recurrences. In addition, Zoho provides time and expense tracking like other invoicing platforms with pop-up timers. However, each function has been pared down to ensure that you don’t get lost in the details. Nevertheless, due to its lower financial requirements, it’s a preferable option for those who might be intimidated by a more robust system.

The integration potential of Zoho could be its most important selling feature. In addition to Zoho’s online payment mechanism, the company offers various other services, including Zoho CRM, Projects, and Cliq (a group chats app similar to Slack). In addition, for $1 per day per employee, Zoho offers a subscription to its whole business operating platform, Zoho One, which includes its connectors.

Tipalti

What’s the best billing software out there? Even though Tipalti is geared toward medium-sized firms, small businesses can also use it. Tipalti is ideally suited for small firms’ international and B2B activities. As the most complicated program on this list, Tipalti also provides the most comprehensive accounting solution.

ALSO SEE: LMS Software

It’s a vital piece of software, but only an expert could get the most out of it. Tipalti is well known for its accounts payable skills, but it can also handle your invoicing and online billing, among other things. As a result, Tipalti could be the best invoice software free for a small business that you own if you have the skill or if you have a skilled staff.

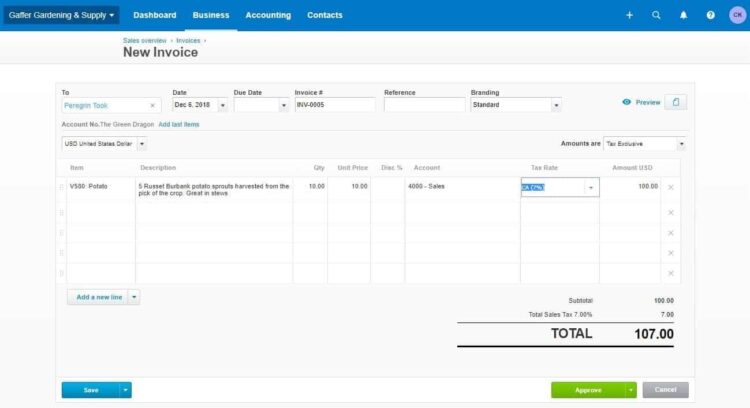

Xero

Your small business will benefit greatly from Xero’s all-in-one functionality. Streamline operations, maintain accurate data, and simplify regulatory compliance all at the same time.

All Xero features:

1. Send invoices

Immediately after completing a task, billing your clients is a time-saver.

2. Pay bills

Track & pay bills on time. And find an apparent summary of accounts payable and cash flow.

3. Claim expenses

Simplify employee expense claims. Catch costs, submit, approve and reimburse claims, and see spending.

4. Bank connections

Join your bank into Xero and install bank feeds. Transactions flow securely right into Xero each business day.

5. Accept payments

Accept online bill payments and have paid up to twice as quickly by connecting to Stripe, GoCardless, along many others.