The SR-50 is an auto insurance form also known as Affidavit of the current insurance and this form is unique to Indiana. It is necessary to fill the SR-50 for restoring the driving privileges when the suspension is over. All the states have their own rules related to driving. Definitely, there are similarities in the state laws but there are some differences as well. Like the state of Indiana needs the SR-50 which is a unique form and it must be submitted by the driver when their license privileges get suspended.

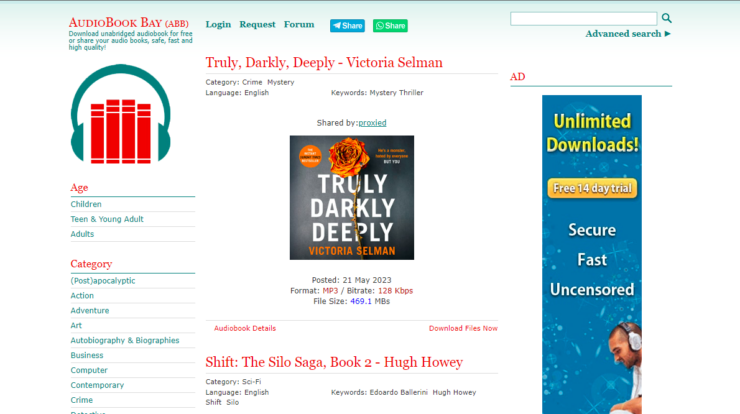

Car insurance

The title of SR-50 is ‘Affidavit of the current insurance’. This form means it is proof that the driver has ‘car insurance’. It is important for the driver to have a minimum amount of insurance. There is no requirement set if you want to purchase more than the set minimum amount. Those drivers who have got the license suspensions are hard to insure and generally are the risky drivers. A lot of may also get confused that why this special form should be procured when the insurance proof is available when you purchase a policy of auto insurance. The state of Indiana does not want to rely on the driver for mailing. The Insurance Company must file the important paperwork as the state wants.

There are some forms specifically made to reflect the few specific circumstances about the history of the driver. The insurance proof will not be enough for the drivers. So, that time SR50 insurance form comes into play for the driver whose driving privileges are suspended because of egregious behavior. Until the SR-50 is filed, the state of Indiana will not reinstate the driver’s license. The SR-50 must be filed with the Indiana Bureau of Motor vehicles. It may seem that the state of Indiana is strict than other states in terms of filing the insurance proof. The insurer also needs to present COC (Certificate of Compliance) in addition to the SR-50 form. The certificate of compliance must be filed only in the four conditions given below:-

- If the auto accident happens and the report of the accident is submitted to BMV.

- When the traffic violation of the driver rises to the level of felony or misdemeanor.

- When the driver gets ‘pointable’ moving violation in just one year after the already 2 pointable violations are committed.

- If the driver receives a pointable violation just after the suspension due to the insurance proof.

Auto Insurance Proof

All the above-given conditions can be deemed times rather than the exclusive times. According to the law, the state of Indiana may ask for insurance proof under any circumstance. The state of Indiana wants a high-risk driver to have insurance. It wants auto insurance proof before the driving privileges are restored as there are concerns of risk. So, anyone who chooses not to carry the insurance by violating the rules of the state reflects the risk. So, for providing the proof to

BMV has become necessary before the state decides to reissue the license.

High-risk drivers should be more deliberate when they search for insurance. As when you do random calls to some auto insurance companies can lead to rejection. The cost of getting the minimum coverage may be high from the previously suspended driver rather than from someone who never had infractions. The high-risk driver is the person who has incurred several offenses. Any policyholder who has insurance history with different claims may be at high risk. Any individual with multiple BMV points and restricted driving privileges is at greater risk. All drivers who are struggling with various moving violations may also feel much overloaded by the purchase of auto insurance

The Risky Driver

There are various concerns over the risk and this is the reason the state of Indiana needs basic auto insurance before the privileges of lost driving are restored. Anyone who has smashed many points that the driving privileges had to be suspended also reflects the risk of an accident. Anyone who chooses not to carry the insurance by violating the rules of the state reflects the risk. So before the state reissues the license, it is very important to provide the proof to BMV. The most important issue of the suspended driver is how after the suspension, he/she can get affordable car insurance. When the comparison is done for the quality car insurance, then it will help you to find the honest rates. Whatever may be the person’s background, there is the possibility of acquiring auto insurance.

High Risk

The high-risk driver is the one who has done a lot of violations. Any policyholder who has insurance history with different claims can have high risk. Any person with many BMV points and with the suspended driving privileges shows an elevated risk. All the drivers who struggle with various moving violations may also feel very overwhelmed about the auto insurance purchase.